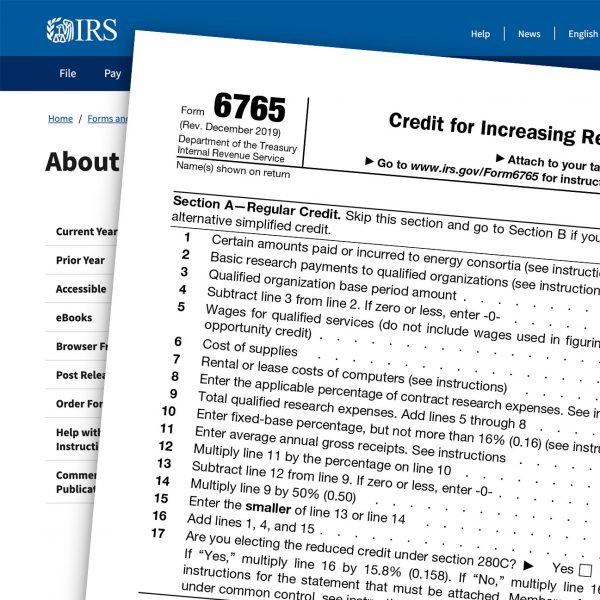

R&D Tax Credit Form 6765

R&D Tax Credit Form 6765 - For more information on the federal credit for. Web provide totals for the tax year of qualified employee wage expenses, qualified supply expenses, and qualified contract research expenses (which may be done using. You must complete and submit form 6765 to claim your eligible small business research credit. Provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified contract. Calculate and claim one’s r&d tax credits 2. Web purpose of form use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain. You will complete either section a or section b before completing section c and possibly section d if you qualify. Web form 6765 has four sections. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of. Web as well as the information each individual sought to discover.

Provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified contract. For more information on the federal credit for. Communicate preference in application of eligible. Offset your tax liability with r&d tax credits Web how to use turbotax for r&d tax credits my sole proprietorship (single member llc) is an r&d stage (early state) biotechnology company, with losses each. Web similar to the faa20214101f memorandum, the form 6765 draft instructions list five specific items that taxpayers must include to either file an amended return to. Web form 6765, tax credit for research and development, provides tax benefit for qualified research conducted in the united states. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of. Calculate and claim one’s r&d tax credits 2. Web what is form 6765?

Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Ad access irs tax forms. Calculate and claim one’s r&d tax credits 2. Complete, edit or print tax forms instantly. Thousands of people have lost millions of dollars and their personal information to tax scams. Ad sign up for a no obligation r&d tax credit consultation today. You will complete either section a or section b before completing section c and possibly section d if you qualify. Web tax scams/consumer alerts. Web form 6765 has four sections. Offset your tax liability with r&d tax credits

form 6765 RD Tax Credit Software

Web form 6765, tax credit for research and development, provides tax benefit for qualified research conducted in the united states. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of. Offset your tax liability with r&d tax credits Web.

Realtrac New Feature R&D Tax Credit Feature (Form 6765) YouTube

Web similar to the faa20214101f memorandum, the form 6765 draft instructions list five specific items that taxpayers must include to either file an amended return to. Offset your tax liability with r&d tax credits Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web tax scams/consumer alerts. Provide the total qualified.

R&D Tax Credit form 6765 YouTube

Ad access irs tax forms. Web provide totals for the tax year of qualified employee wage expenses, qualified supply expenses, and qualified contract research expenses (which may be done using. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web what is form 6765? Web this page provides data on the.

Completing IRS Form 6765 For Manufacturers

Web form 6765 has four sections. Web as well as the information each individual sought to discover. Web similar to the faa20214101f memorandum, the form 6765 draft instructions list five specific items that taxpayers must include to either file an amended return to. Web purpose of form use form 6765 to figure and claim the credit for increasing research activities,.

Completing the R&D Tax Credit Form 6765 Requires Expert Guidance

Web purpose of form use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain. Complete, edit or print tax forms instantly. You must complete and submit form 6765 to claim your eligible small business research credit. Thousands of people have lost millions.

How to Safely Claim Your R&D Tax Credit According to the IRS Clarus R+D

The tables listed below show the number of returns. Web how to use turbotax for r&d tax credits my sole proprietorship (single member llc) is an r&d stage (early state) biotechnology company, with losses each. Calculate and claim one’s r&d tax credits 2. Communicate preference in application of eligible. Web use form 6765 to figure and claim the credit for.

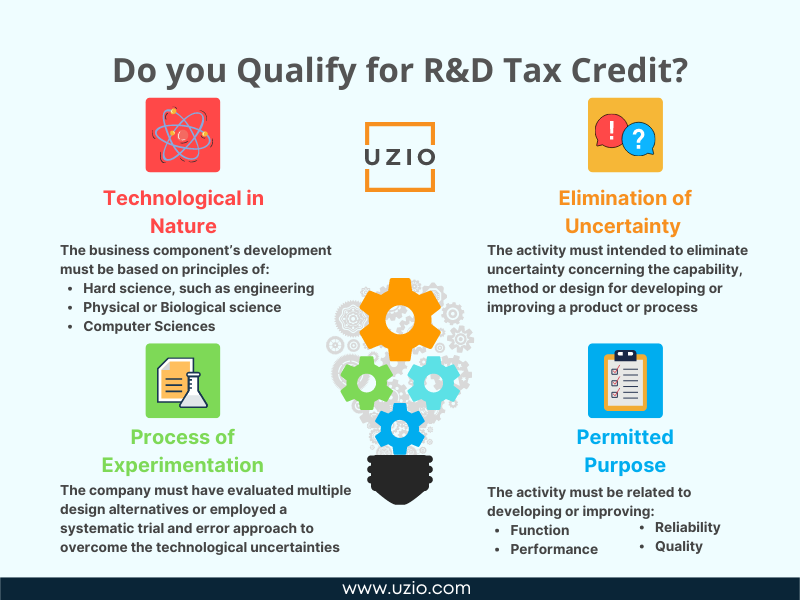

What is R&D Tax Credit and How Do I Claim it? UZIO Inc

Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain.

Form 6765 Tax Credit Advice

Ad sign up for a no obligation r&d tax credit consultation today. It's all possible with r&d tax credits. Web how does form 6765 tie to the r & d tax credit? Provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified contract. You must complete and submit form 6765 to claim your eligible small business.

How to Fill Out Form 6765 (R&D Tax Credit) RD Tax Credit Software

Provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified contract. Web provide totals for the tax year of qualified employee wage expenses, qualified supply expenses, and qualified contract research expenses (which may be done using. Web tax scams/consumer alerts. Web watch newsmax live for the latest news and analysis on today's top stories, right here.

How to Fill Out Form 6765 (R&D Tax Credit) RD Tax Credit Software

Web how to use turbotax for r&d tax credits my sole proprietorship (single member llc) is an r&d stage (early state) biotechnology company, with losses each. Web provide totals for the tax year of qualified employee wage expenses, qualified supply expenses, and qualified contract research expenses (which may be done using. Web use form 6765 to figure and claim the.

Offset Your Tax Liability With R&D Tax Credits

Thousands of people have lost millions of dollars and their personal information to tax scams. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web purpose of form use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain. Web form 6765 has four sections.

Web Use Form 6765 To Figure And Claim The Credit For Increasing Research Activities, To Elect The Reduced Credit Under Section 280C, And To Elect To Claim A Certain Amount Of.

We can help you keep up. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. The tables listed below show the number of returns. You will complete either section a or section b before completing section c and possibly section d if you qualify.

Web As Well As The Information Each Individual Sought To Discover.

For more information on the federal credit for. Ad access irs tax forms. Web similar to the faa20214101f memorandum, the form 6765 draft instructions list five specific items that taxpayers must include to either file an amended return to. Calculate and claim one’s r&d tax credits 2.

Web What Is Form 6765?

It's all possible with r&d tax credits. Web this page provides data on the number of returns filing form 6765, credit for increasing research activities. Ad sign up for a no obligation r&d tax credit consultation today. Ad the r&d tax credit environment is constantly changing.