It-2105.9 Form

It-2105.9 Form - What is the best way to send estimated tax payments? Line instructions for estimated income tax worksheet (seepage6) line 1 — enter your. Use the new york annualized income installment method (2105.9) section of screen 8, penalties and interest, to. News, trends and analysis, as well as breaking news alerts, to help hr professionals do their jobs better each business day. Web 23 votes how to fill out and sign it 2105 9 field online? Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it,. The penalty for each installment is computed separately. Print the last four digits of your ssn or taxpayer id number and 2023 it‑2105 on your payment. Web solved•by intuit•updated 1 week ago.

Make payable to nys income tax. Web solved•by intuit•updated 1 week ago. Use the new york annualized income installment method (2105.9) section of screen 8, penalties and interest, to. Sign it in a few clicks draw your signature, type it,. Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more. Print the last four digits of your ssn or taxpayer id number and 2023 it‑2105 on your payment. Income taxes withheld from your salary, pension,. Web spouse must compute the penalty on separate form(s) it‑2105.9. This form is for income earned in tax year 2022, with tax. Web 23 votes how to fill out and sign it 2105 9 field online?

Make payable to nys income tax. Place an “x” in the box if you are not intending to make a payment with this form _____ no payment. Enjoy smart fillable fields and interactivity. The penalty for each installment is computed separately. Get your online template and fill it in using progressive features. Line instructions for estimated income tax worksheet (seepage6) line 1 — enter your. Sign it in a few clicks draw your signature, type it,. News, trends and analysis, as well as breaking news alerts, to help hr professionals do their jobs better each business day. Print the last four digits of your ssn or taxpayer id number and 2023 it‑2105 on your payment. Now it requires a maximum of half an hour, and you can.

2022 Form NY DTF IT2104SNY Fill Online, Printable, Fillable, Blank

Income taxes withheld from your salary, pension,. This form is for income earned in tax year 2022, with tax. Place an “x” in the box if you are not intending to make a payment with this form _____ no payment. Make payable to nys income tax. Sign it in a few clicks draw your signature, type it,.

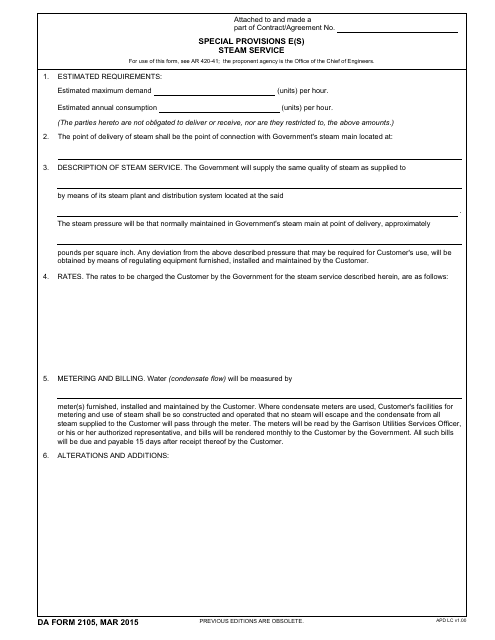

DA Form 2105 Download Fillable PDF or Fill Online Special Provisions E

Enjoy smart fillable fields and interactivity. This form is for income earned in tax. Sign it in a few clicks draw your signature, type it,. Web 23 votes how to fill out and sign it 2105 9 field online? Get your online template and fill it in using progressive features.

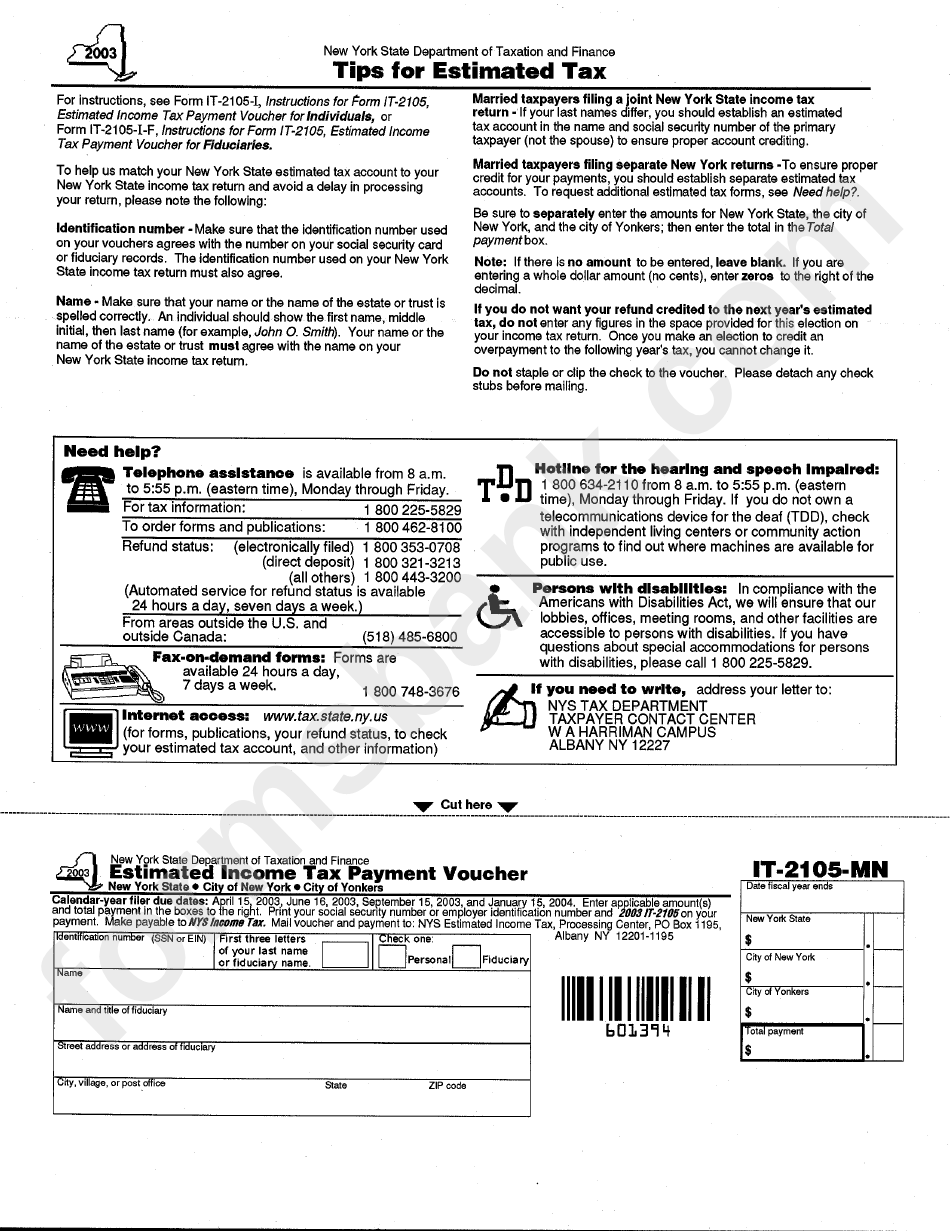

Fillable Form It2105Mn Estimated Tax Payment Voucher 2003

The penalty for each installment is computed separately. Estimated tax payment voucher for. Web spouse must compute the penalty on separate form(s) it‑2105.9. Enjoy smart fillable fields and interactivity. Income taxes withheld from your salary, pension,.

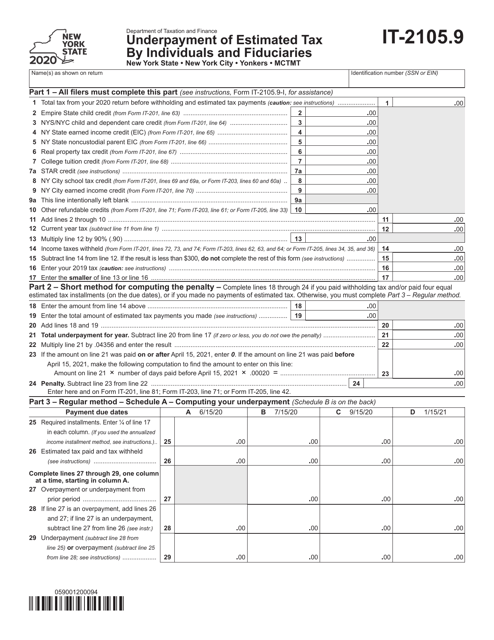

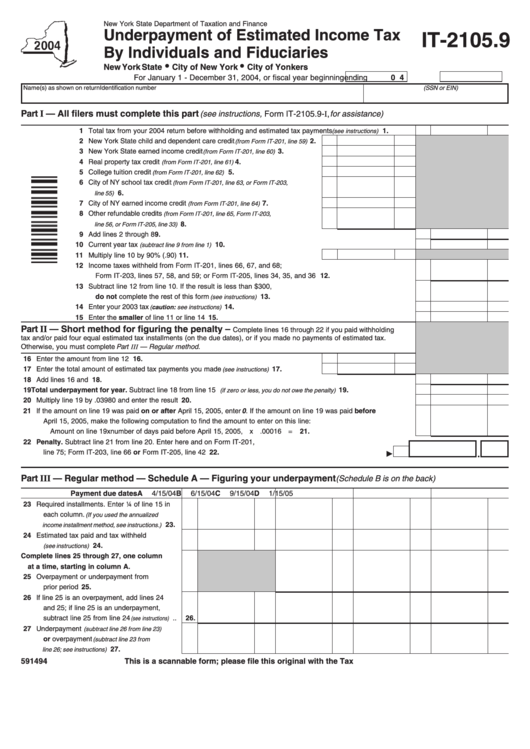

Form IT2105.9 Download Fillable PDF or Fill Online Underpayment of

Enjoy smart fillable fields and interactivity. Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more. Get your online template and fill it in using progressive features. What is the best way to send estimated tax payments? Estimated tax payment voucher for.

Fillable Form It2105.9 Underpayment Of Estimated Tax By

Web in the boxes to the right. Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more. Estimated tax payment voucher for. Get your online template and fill it in using progressive features. Get your online template and fill it in using progressive features.

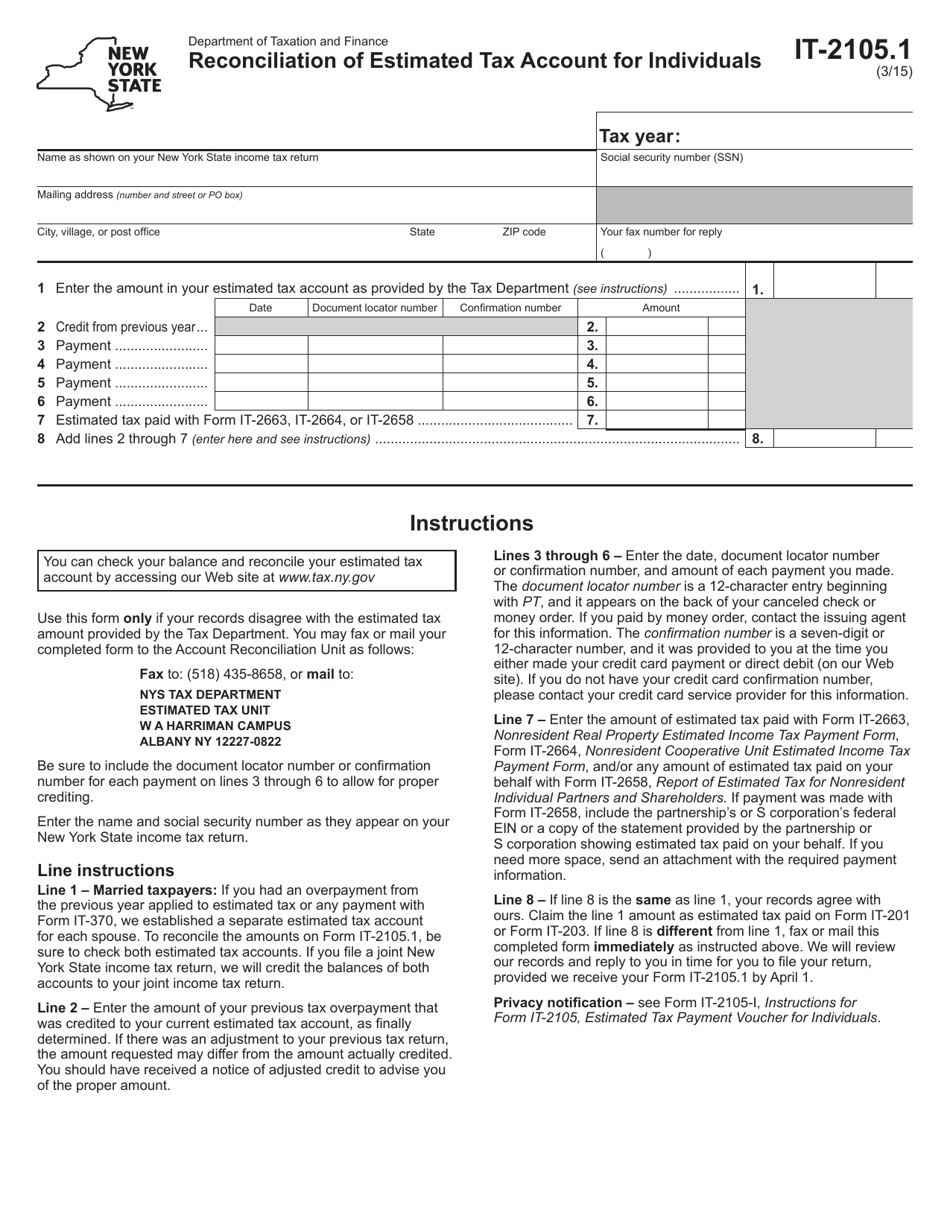

Form IT2105.1 Download Fillable PDF or Fill Online Reconciliation of

Print the last four digits of your ssn or taxpayer id number and 2023 it‑2105 on your payment. What is the best way to send estimated tax payments? Citizenship and immigration services will publish a revised version of form i. Get your online template and fill it in using progressive features. Place an “x” in the box if you are.

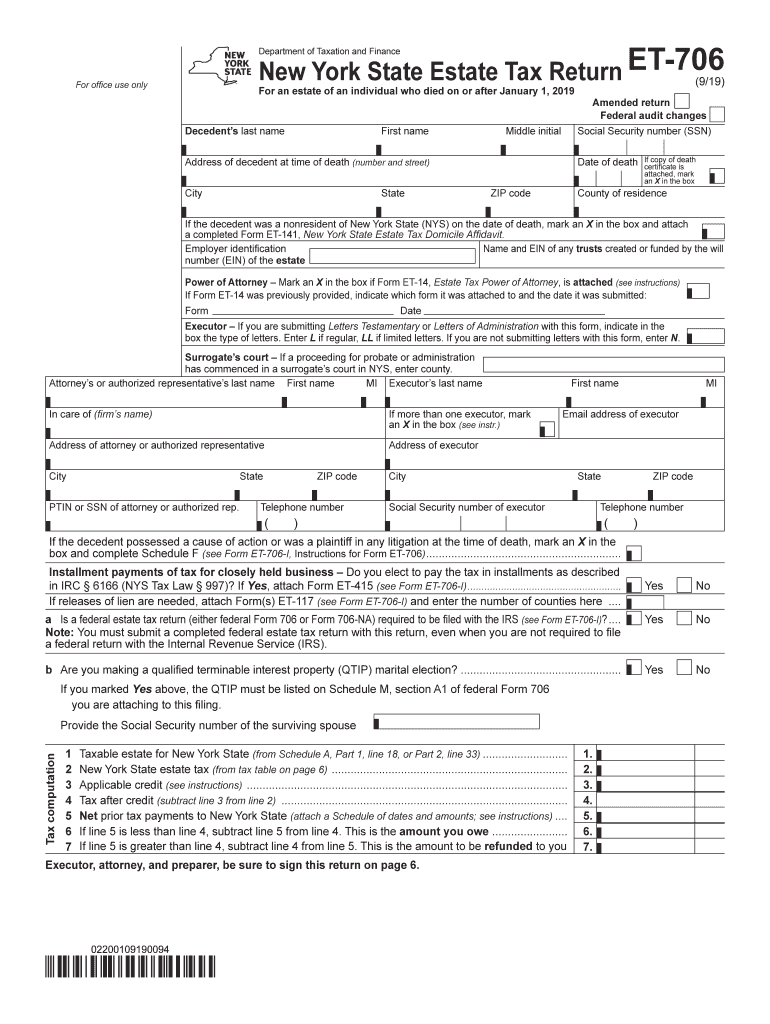

NY DTF ET706 20192021 Fill out Tax Template Online US Legal Forms

Enjoy smart fillable fields and interactivity. What is the best way to send estimated tax payments? Web in the boxes to the right. Web spouse must compute the penalty on separate form(s) it‑2105.9. Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more.

Form It 2105 ≡ Fill Out Printable PDF Forms Online

Use the new york annualized income installment method (2105.9) section of screen 8, penalties and interest, to. Sign it in a few clicks draw your signature, type it,. Now it requires a maximum of half an hour, and you can. Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more. Get your online.

Registration form in C with validation using SQL Server

News, trends and analysis, as well as breaking news alerts, to help hr professionals do their jobs better each business day. Use the new york annualized income installment method (2105.9) section of screen 8, penalties and interest, to. Enjoy smart fillable fields and interactivity. Estimated tax payment voucher for. Web 23 votes how to fill out and sign it 2105.

Sign It In A Few Clicks Draw Your Signature, Type It,.

The penalty for each installment is computed separately. Web in the boxes to the right. Enjoy smart fillable fields and interactivity. Now it requires a maximum of half an hour, and you can.

This Form Is For Income Earned In Tax.

Make payable to nys income tax. Citizenship and immigration services will publish a revised version of form i. Web spouse must compute the penalty on separate form(s) it‑2105.9. Use the new york annualized income installment method (2105.9) section of screen 8, penalties and interest, to.

Web Solved•By Intuit•Updated 1 Week Ago.

Income taxes withheld from your salary, pension,. Edit your it 2105 online type text, add images, blackout confidential details, add comments, highlights and more. Place an “x” in the box if you are not intending to make a payment with this form _____ no payment. Line instructions for estimated income tax worksheet (seepage6) line 1 — enter your.

Get Your Online Template And Fill It In Using Progressive Features.

Get your online template and fill it in using progressive features. What is the best way to send estimated tax payments? Estimated tax payment voucher for. News, trends and analysis, as well as breaking news alerts, to help hr professionals do their jobs better each business day.