Illinois R&D Tax Credit Form

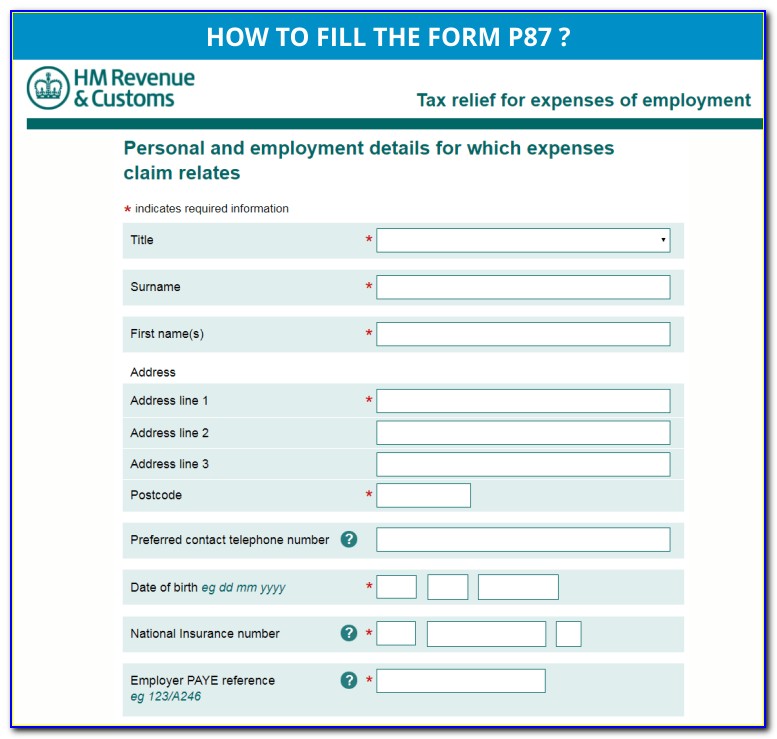

Illinois R&D Tax Credit Form - However, this is not an automatic credit applied to a tax bill. Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. Web income tax credits information and worksheets what’s new for 2021? Web section 100.2160 research and development credit (iita section 201(k)) a) for tax years ending after july 1, 1990 and prior to december 31, 2003, and tax years ending on or. Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all act credits. Claim up to 250k annually. Web included in the $36 billion spending plan is an extension of the state’s research and development tax credit through december 31, 2021. • the reimagining electric vehicles (rev) illinois investment credit (code 5230) is effective for tax years. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: This is your tax credit.

Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. Companies need to qualify and apply for the credit to obtain it. Find out if you qualify for r&d tax credits in illinois and recharge your business. Claim up to 250k annually. Web income tax credits information and worksheets what’s new for 2021? It's all possible with r&d tax credits. Web so, yes, r&d tax credits are available in illinois. Ad r&d credits are available in the manufacturing industry. Web illinois research and development tax credit explained. Web illinois r&d tax credits.

Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. For research activities conducted in the state of illinois, an r&d credit is available against income taxes until. Ad r&d credits are available in the manufacturing industry. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. It's all possible with r&d tax credits. For tax years ending on or after. Web illinois state r&d tax credit. Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all act credits. Web illinois r&d tax credits. Ad unlock r&d tax credits for your business & get the savings you're owed with gusto payroll.

What is the R&D Tax Credit? Froehling Anderson

Claim up to 250k annually. Unused credit can be carried forward up to 5 years. Choose gusto for payroll and save thousands with the research and development tax credit. Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. For.

R&D Tax Credit Denied Where Taxpayer Failed to Demonstrate And Document

Web included in the $36 billion spending plan is an extension of the state’s research and development tax credit through december 31, 2021. Web illinois is one of many states finally taking note of the r&d tax credit and how they are extremely beneficial for the economy and business growth throughout the. Web watch newsmax live for the latest news.

R&d Tax Credit Form Irs Form Resume Examples e4k4ErADqN

Web illinois state r&d tax credit. Web form il‑1040, line 15. Ad sign up for a no obligation r&d tax credit consultation today. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Ad r&d credits are available in the manufacturing industry.

The R&D Tax Credit Driving American Innovation & Job Creation

Find out if you qualify for r&d tax credits in illinois and recharge your business. Web illinois r&d tax credits. Companies need to qualify and apply for the credit to obtain it. Web income tax credits information and worksheets what’s new for 2021? Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited.

Which Industries Qualify for the R&D Tax Credit? Specialist R&D Tax

Web illinois r&d tax credits. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. It's all possible with r&d tax credits. Ad sign up for a no obligation r&d tax credit consultation today. Ad unlock r&d tax credits for your business & get.

What Is an R&D Tax Credit?

Choose gusto for payroll and save thousands with the research and development tax credit. Ad sign up for a no obligation r&d tax credit consultation today. Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. Offset your tax liability.

Illinois State R&D Tax Credit

Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. Unused credit can be carried forward up to 5 years. Web included in the $36 billion spending plan is an extension of the state’s research and development tax credit through.

R&D Tax Credit Guidance for SMEs Market Business News

Web included in the $36 billion spending plan is an extension of the state’s research and development tax credit through december 31, 2021. Section a is used to claim the regular credit and has eight lines. This is your tax credit. Web so, yes, r&d tax credits are available in illinois. Companies need to qualify and apply for the credit.

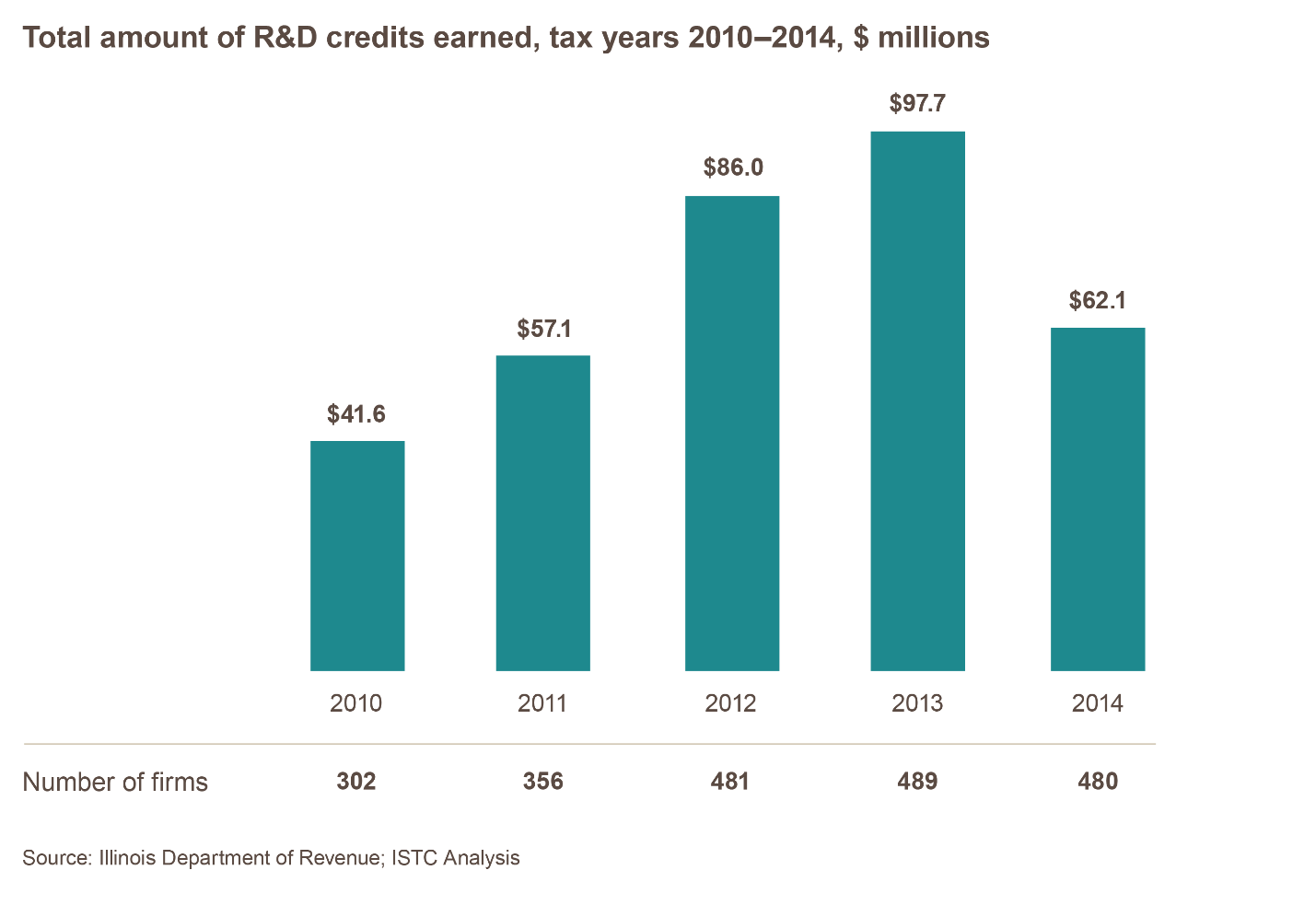

Reinstate the Illinois R&D Tax Credit Illinois Science & Technology

Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Section a is used to claim the regular credit and has eight lines. Web illinois is one of many states finally taking note of the r&d tax credit and how they are extremely beneficial.

The R&D Tax Credit A Strategic Tax Advantage

Web who can apply? Web illinois research and development tax credit explained. This is your tax credit. Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all act credits. Find out if you qualify for r&d tax credits in illinois and recharge your business.

Web Income Tax Credits Information And Worksheets What’s New For 2021?

Web who can apply? Request certain forms from idor. For research activities conducted in the state of illinois, an r&d credit is available against income taxes until. Unused credit can be carried forward up to 5 years.

Web Effective For Tax Years Beginning On Or After January 1, 2021, The Aggregate Credits Are Limited To $20 Million Per Fiscal Year Across All Act Credits.

Choose gusto for payroll and save thousands with the research and development tax credit. Claim up to 250k annually. Ad r&d credits are available in the manufacturing industry. Illinois provides a research and development (r&d) tax credit.

• The Reimagining Electric Vehicles (Rev) Illinois Investment Credit (Code 5230) Is Effective For Tax Years.

For tax years ending on or after. Web illinois state r&d tax credit. Offset your tax liability with r&d tax credits Ad unlock r&d tax credits for your business & get the savings you're owed with gusto payroll.

We'll Help Determine Your Eligibility, Document Your Processes, And Maximize Your Return!

Section a is used to claim the regular credit and has eight lines. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Web illinois r&d tax credits. Web section 100.2160 research and development credit (iita section 201(k)) a) for tax years ending after july 1, 1990 and prior to december 31, 2003, and tax years ending on or.